Client Due Diligence: Ensuring Effective

Risk Management and Regulatory Compliance

Client Due Diligence (CDD) is a fundamental process that regulated businesses, especially in the financial and legal sector, undertake to understand their clients, assess potential risks, and ensure compliance with regulations aimed at preventing financial crimes such as money laundering, terrorism financing, and fraud.

This report outlines five key steps for effective CDD and emphasises their significance in mitigating risks associated with potential clients.

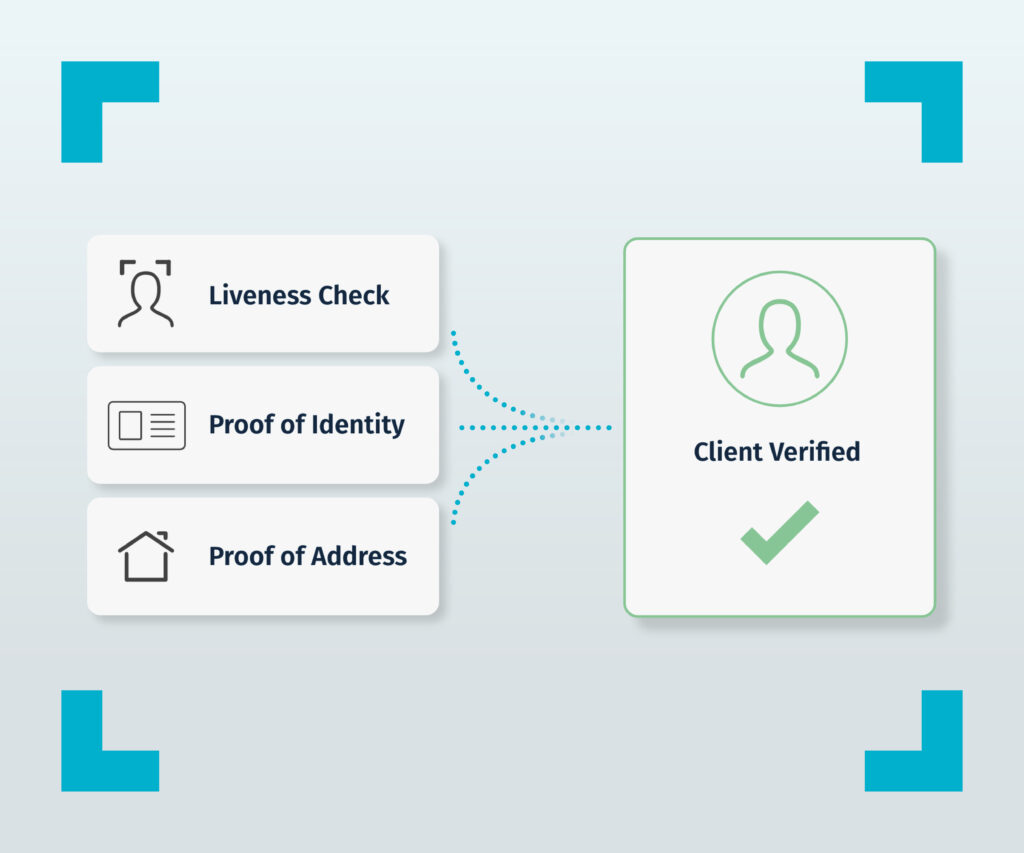

The initial step in CDD involves the meticulous identification and verification of the client’s identity.

Reliable and independent sources must be utilised to collect and authenticate information such as full legal name, address, date of birth, and official identification documents (e.g., passport, driving license, national ID).

The aim is to confirm the authenticity of the provided information and ensure it aligns with credible sources.

We at Validient service individual and commercial clients, offering individual client onboarding (KYC) as well as organisational onboarding (KYB).

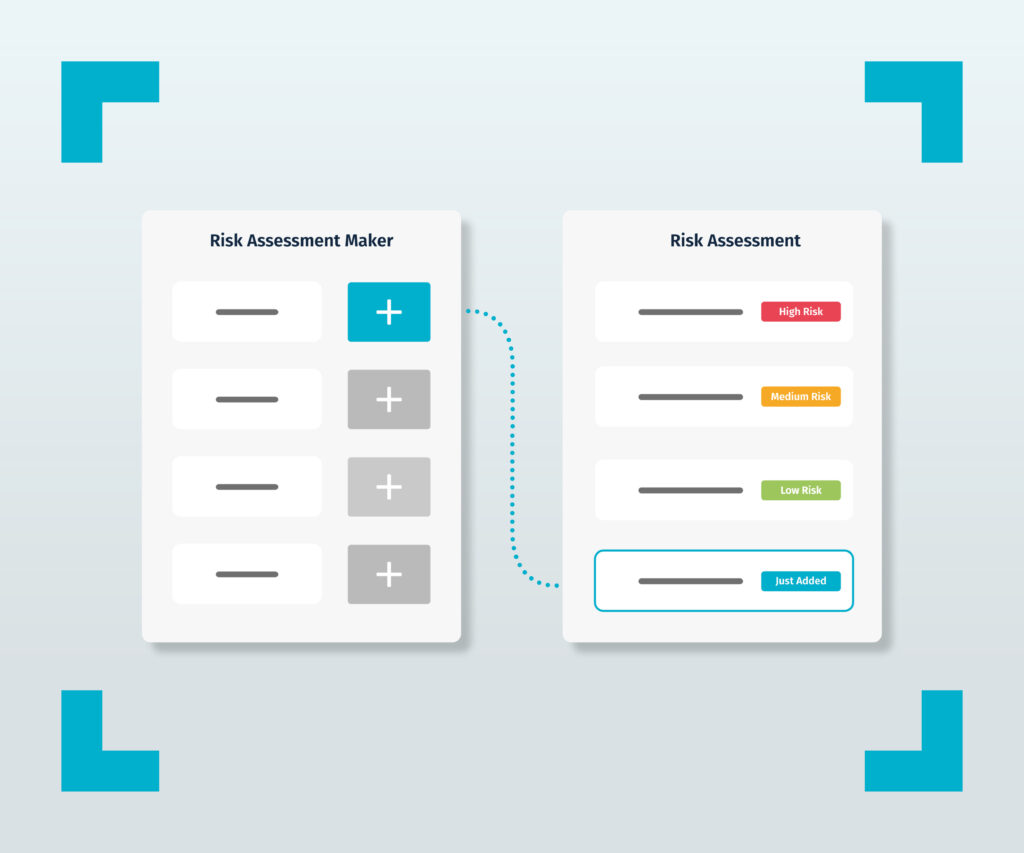

Conducting a comprehensive risk assessment is crucial to understanding the potential risks associated with engaging the client.

Factors such as the client’s reputation, geographical location, industry sector, and the nature of the intended business relationship are evaluated.

This step assists in determining the level of risk the client may pose and aids in establishing appropriate risk mitigation strategies.

With our innovative tool, you can create templates to digitally standardise custom risk assessment forms tailored to the specific needs of your business or industry.

Creating a detailed profile of the client involves gathering information about their financial background, sources of income, ownership Structure & Directors?

By analysing the client’s financial behaviour and patterns, including transaction histories, you can identify irregularities or suspicious activities that may warrant further investigation.

At Validient we offer proof of funds reports, offering a real-time, accurate view of funds. And our beneficial ownership look-up allows you to identify ownership structures and beneficial ownership within organisations.

Having facilities for continuous client monitoring is crucial.

Regularly reviewing and updating client information ensures ongoing compliance with regulations and facilitates the timely detection of any unusual behaviour or changes in circumstances.

This proactive approach is crucial in identifying and preventing potential illicit activities.

Our ongoing client monitoring feature provides real-time updates directly from Companies House, ensuring you stay informed about the current status of your client’s organisation.

Maintaining accurate and up-to-date records of all CDD activities is a must.

Documents and information gathered during the due diligence process, including identification documents, risk assessments, transaction details, and communications with the client, serves as evidence of compliance with regulatory requirements.

Proper record-keeping also facilitates audits and investigations, if necessary.

The Validient dashboard holds all information and documents collected in one secure location. View documents, reports, risk assessments, history logs, client information, and tasks.

Effective client due diligence is paramount in mitigating risks associated with potential clients, complying with regulatory standards, and safeguarding against financial crimes.

Adherence to these five key steps not only ensures a robust CDD process but also demonstrates an organisation’s commitment to ethical business practices and regulatory compliance. Get started today for a free trial, and book a demo.