Introduction

Client Due Diligence (CDD) is required across various industries, with a particular focus on sectors like financial services and the legal industry. The nature of CDD lies in enabling businesses to assess and comprehend their clients thoroughly. This process is integral in mitigating risks associated with financial crimes such as money laundering, fraud, and even potential involvement in activities like terrorist financing.

Despite its significance, several common misconceptions about

Client Due Diligence need clarification. As we delve into the intricacies of this report, we aim to dispel these misconceptions, offering a comprehensive understanding of CDD’s importance, nuances, and innovative tools, like those provided by Validient, that redefine and streamline this crucial process. Let’s unravel the layers of Client Due Diligence to ensure a robust foundation for risk mitigation and regulatory compliance.

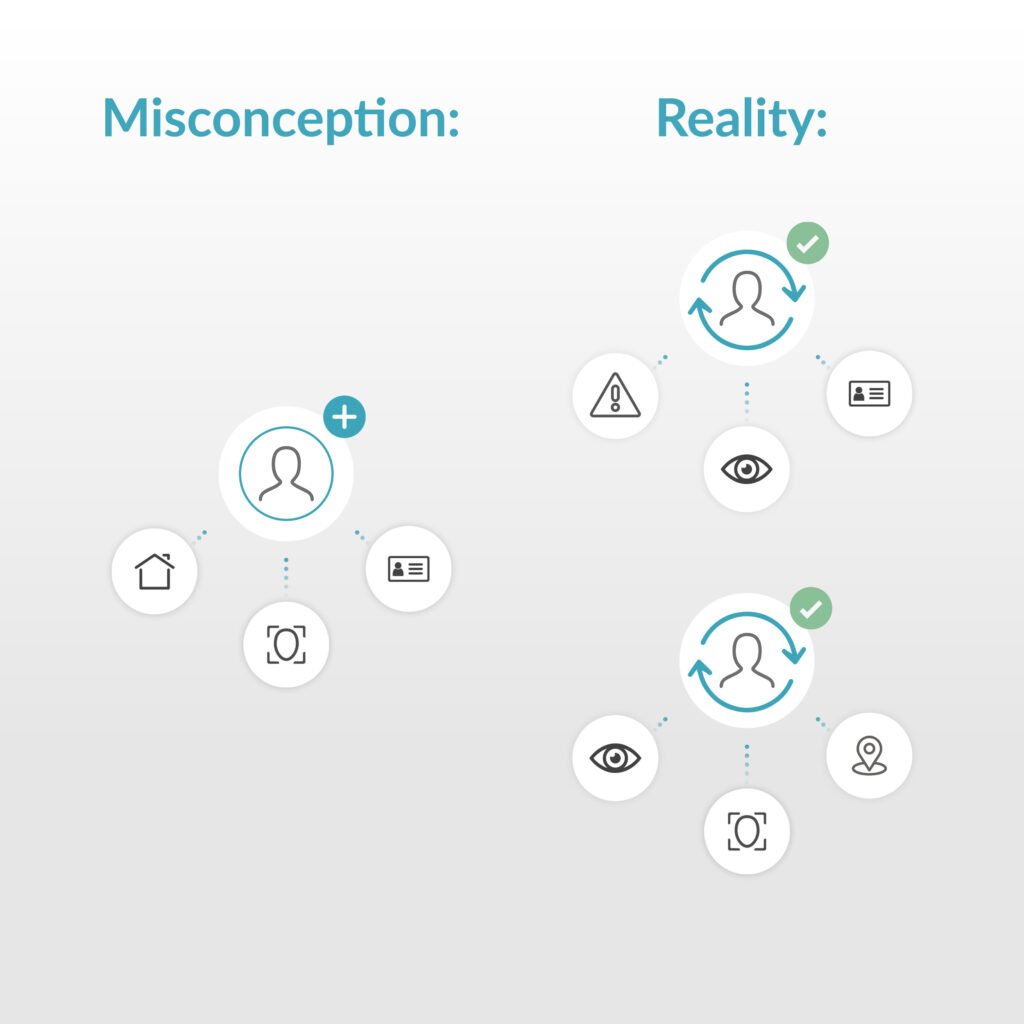

Misconception: Some may believe conducting due diligence on a client

is a one-time event.

Reality: CDD is an ongoing process. Regular updates and reviews are necessary to detect significant changes in the client’s circumstances or business activities that occur over the business relationship.

Misconception: Using a standard template or approach for all clients is sufficient.

Reality: Each client is unique, and the level of due diligence required may vary. It is widely accepted that a risk-based approach should be standard practice when assessing risk, whereby the level of CDD is determined by the presented risks.

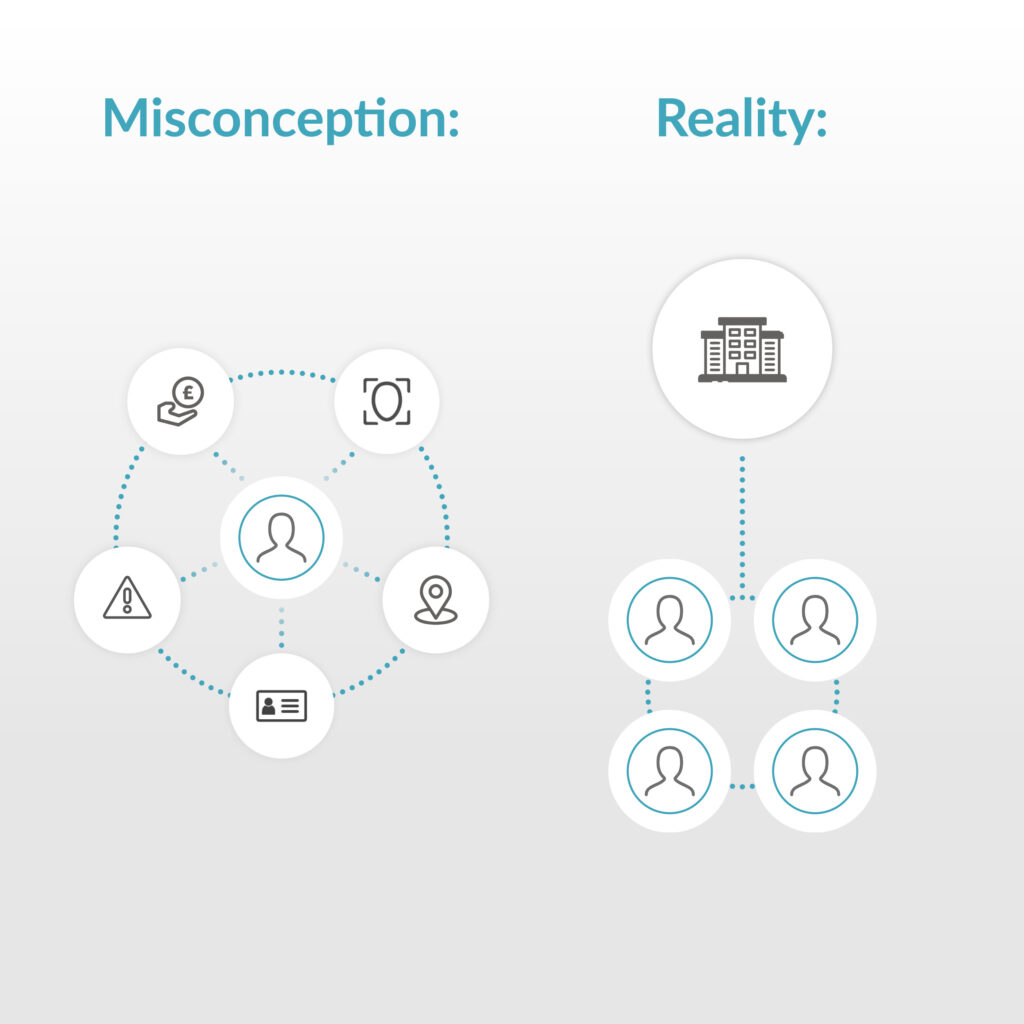

Misconception: CDD is primarily concerned with individual clients.

Reality: CDD also applies to corporate entities. Understanding the ownership structure, beneficial owners, and the business’s nature is crucial in mitigating risks.

Misconception: Viewing CDD as a mere regulatory requirement that adds an administrative burden.

Reality: CDD is not just about compliance; it is a risk management tool. It helps firms protect themselves from financial crimes, fraud, and reputational damage.

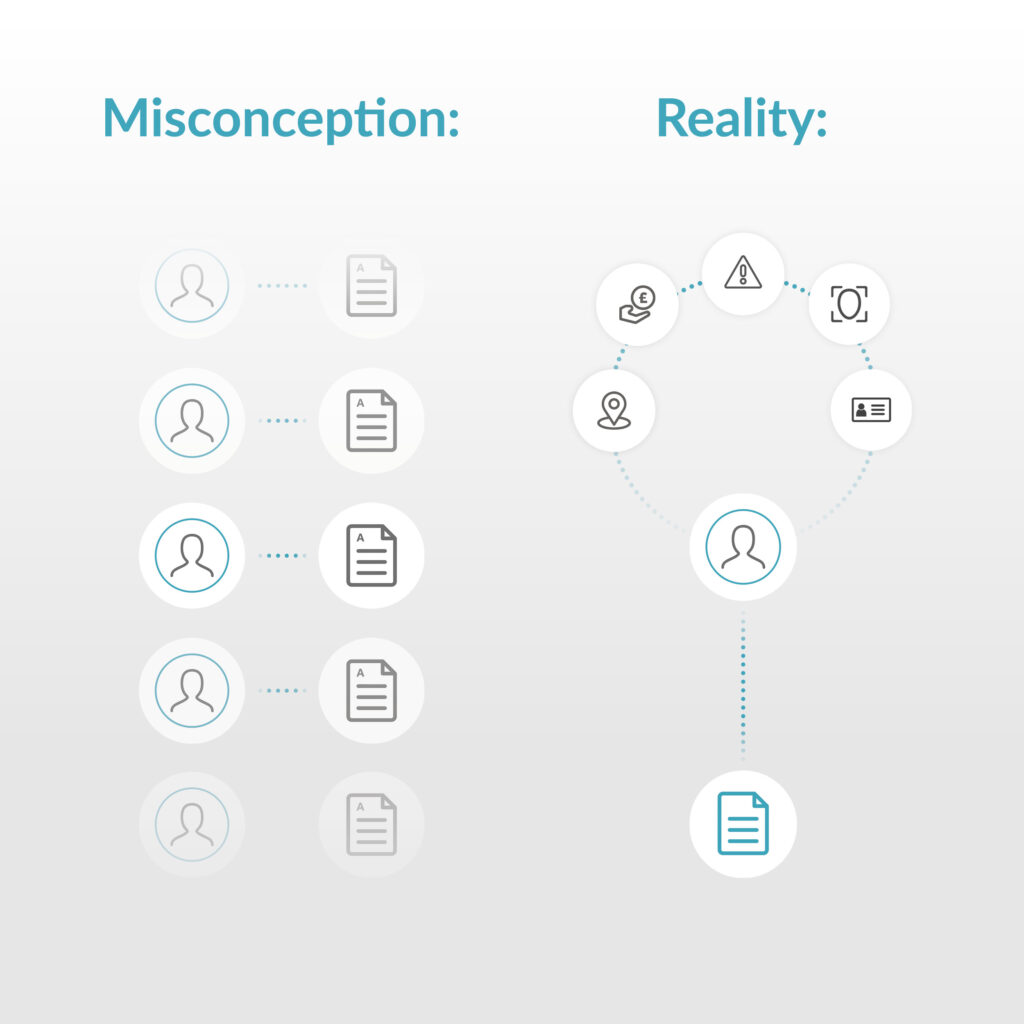

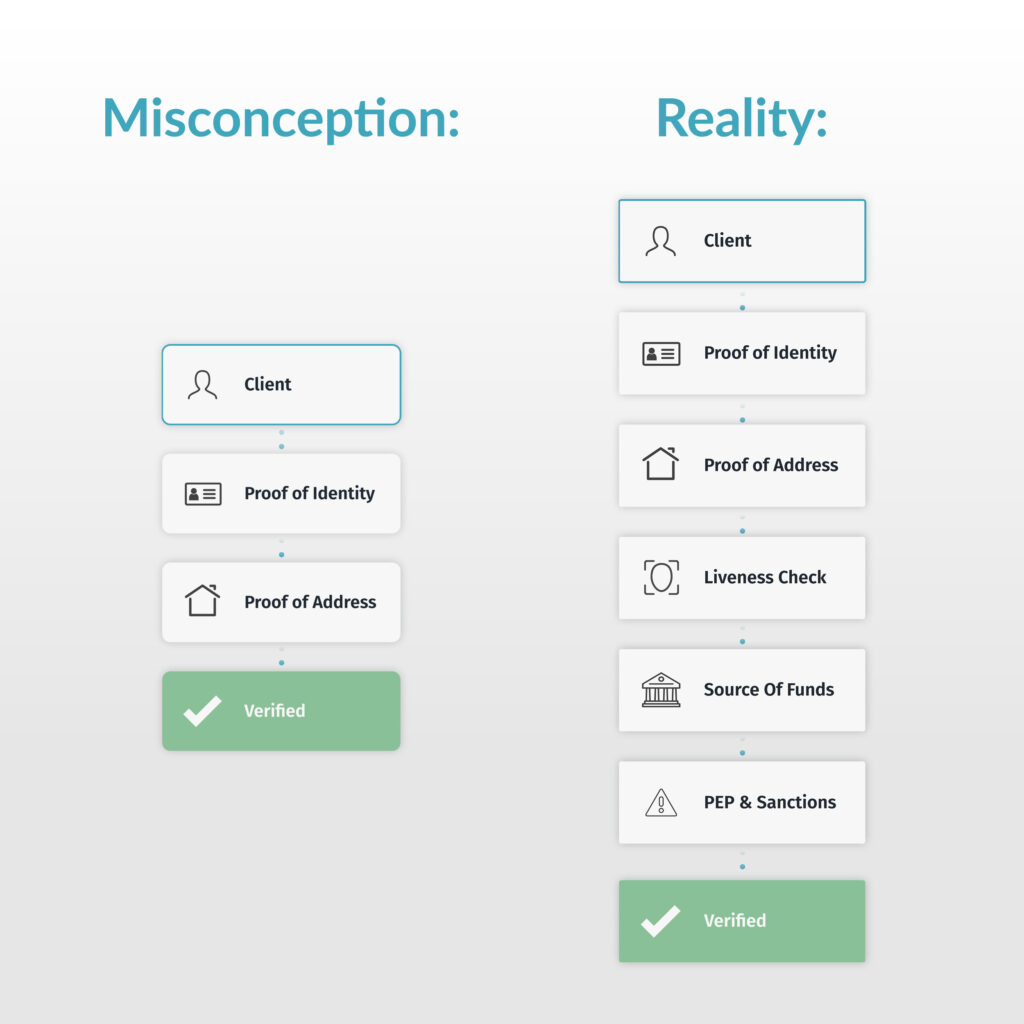

Misconception: Collecting documents, such as identification papers, satisfies CDD requirements.

Reality: While documentation is necessary, true CDD involves a deeper understanding of the client’s background, source of funds, the nature of the business relationship and the associated risks.

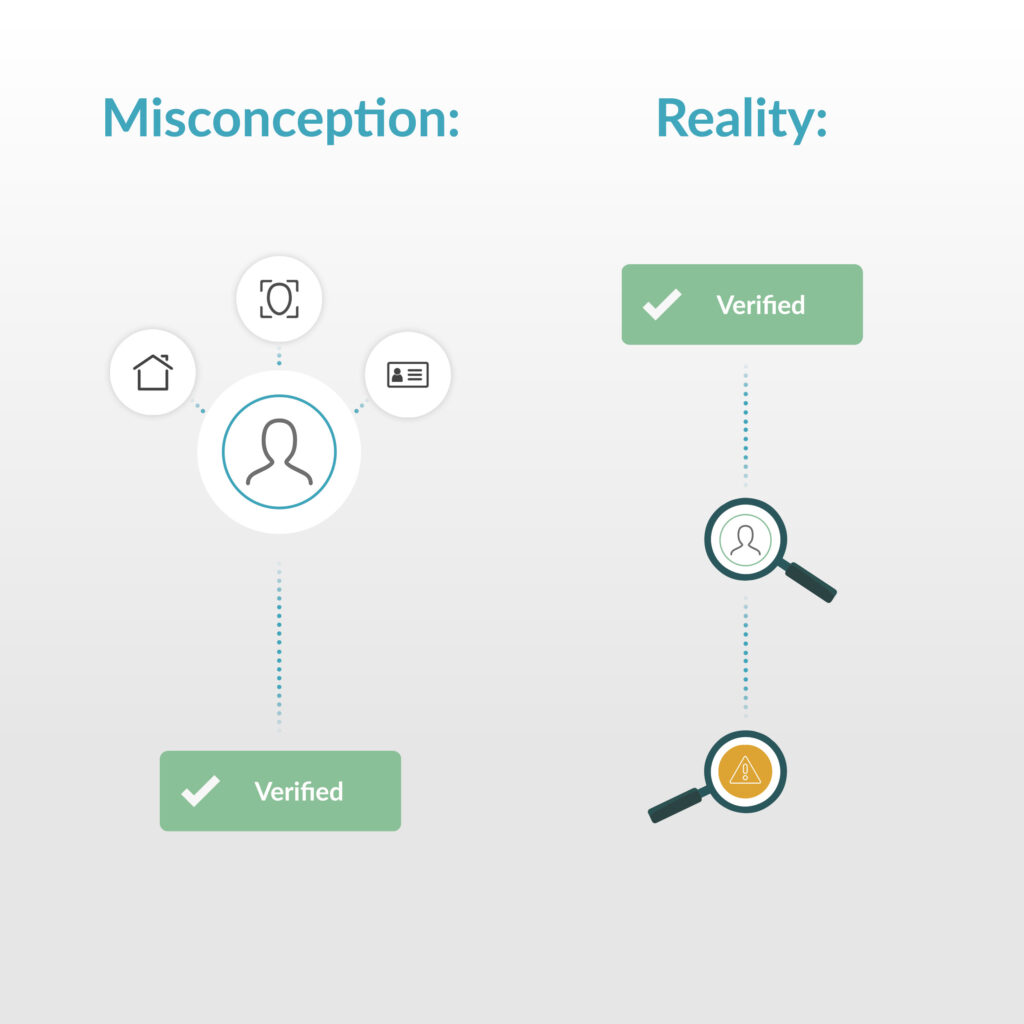

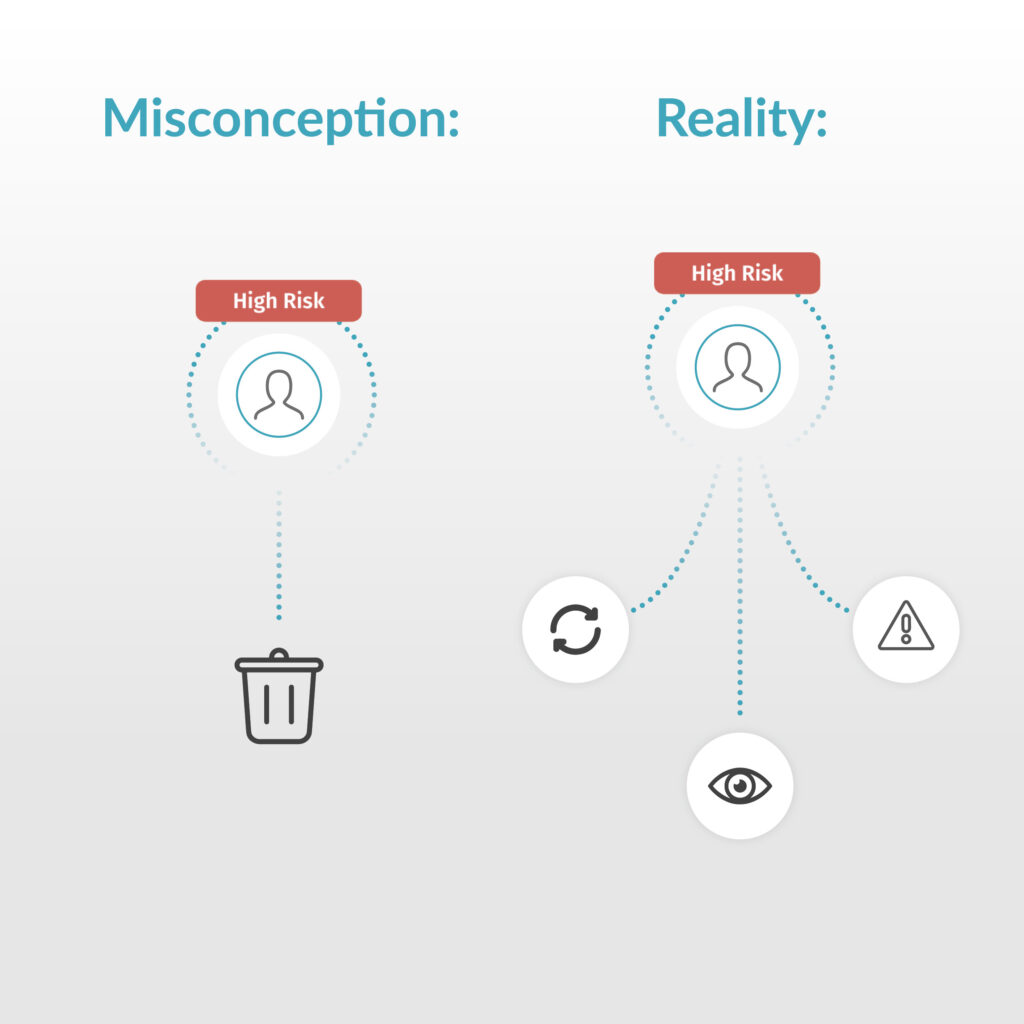

Misconception: If a client is deemed high risk, the immediate response is rejection.

Reality: High-risk clients may still be accepted depending on your firm’s risk profile. Additional due diligence measures will need to be in place, such as frequent and comprehensive reviews to manage and mitigate the associated risks.

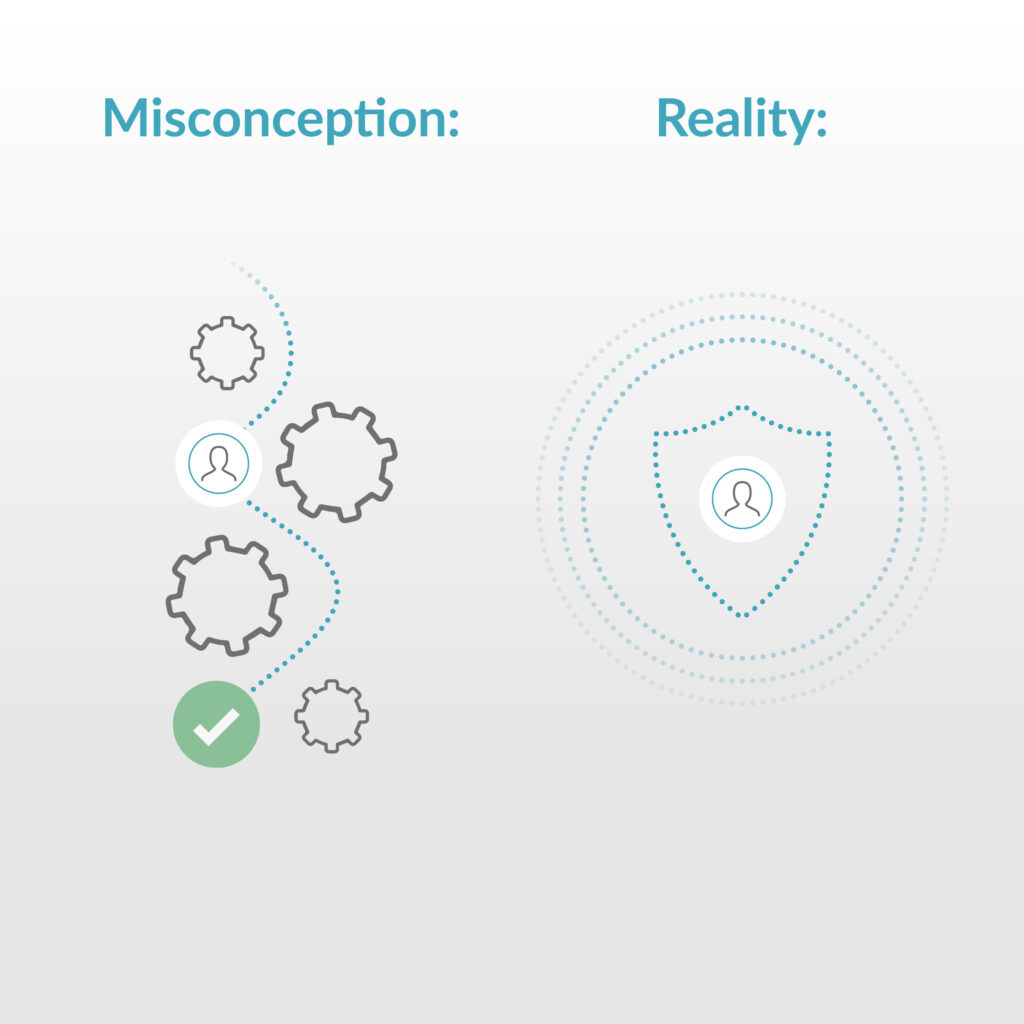

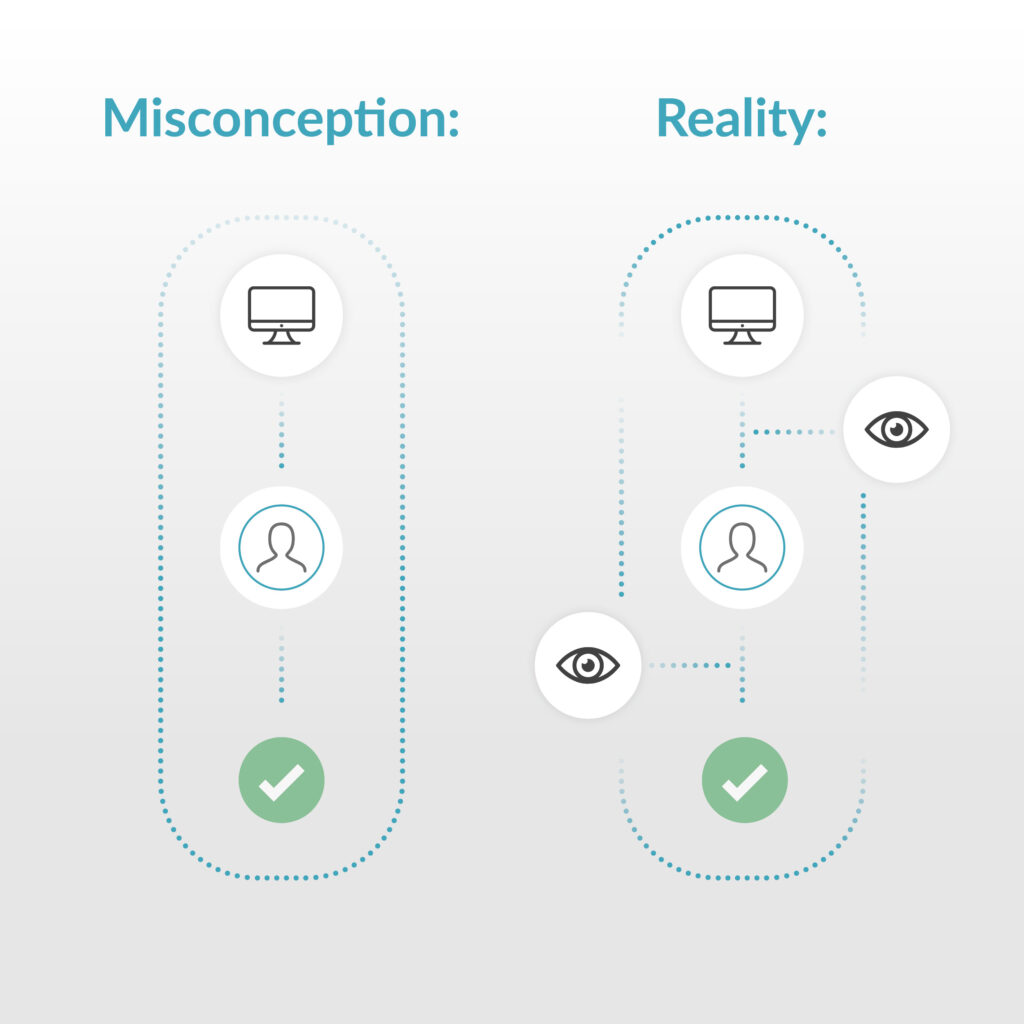

Misconception: Relying solely on automated systems and technology can replace the need for human judgment in the CDD process.

Reality: While technology aids efficiency, human intervention is crucial for interpreting complex information, understanding context, and making nuanced risk assessments. It is important to note that you are ultimately responsible for the decisions that are made.

Misconception: CDD is only necessary when establishing a new client relationship.

Reality: Ongoing monitoring and periodic reviews are crucial even for existing clients, as their circumstances and risk profiles may change over time.

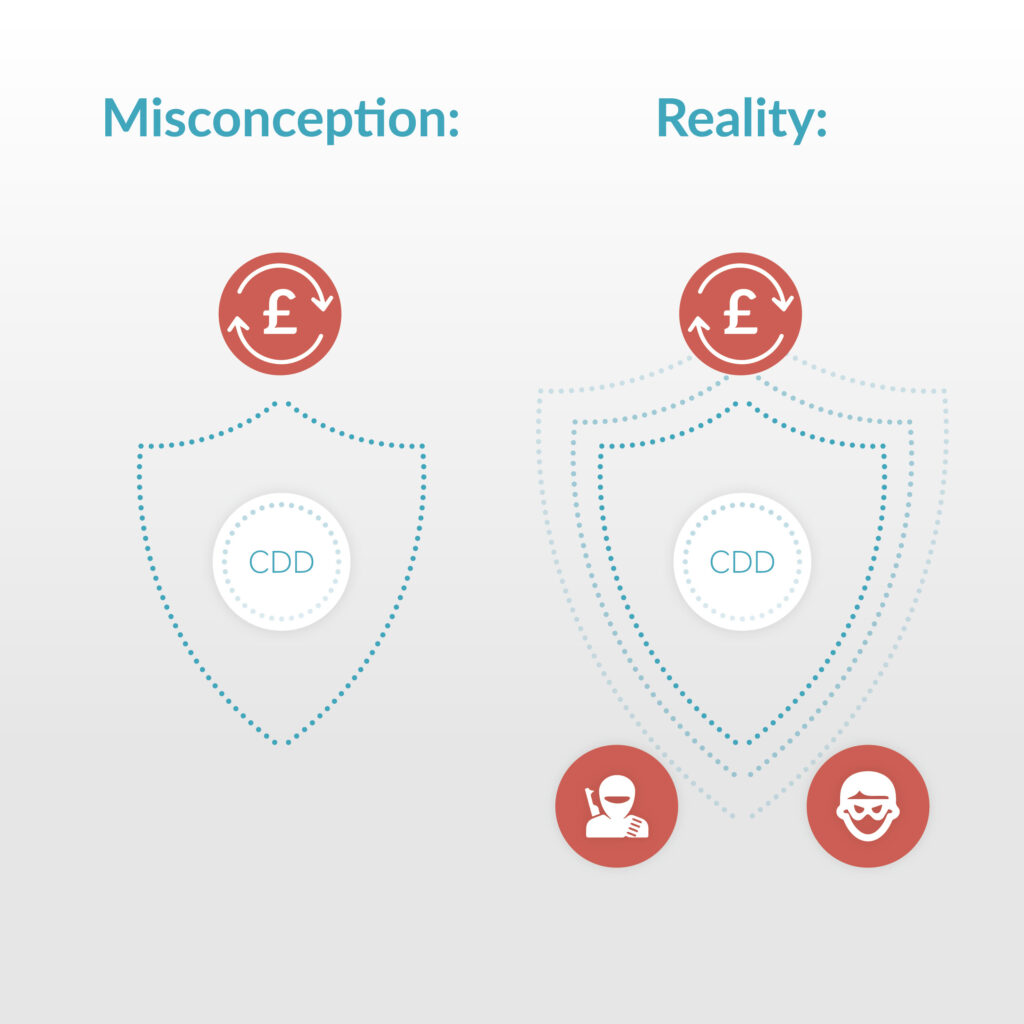

Misconception: CDD is only about preventing money laundering.

Reality: CDD can also lead to identifying and mitigating risks related to various financial crimes, including fraud, corruption, and terrorist financing.

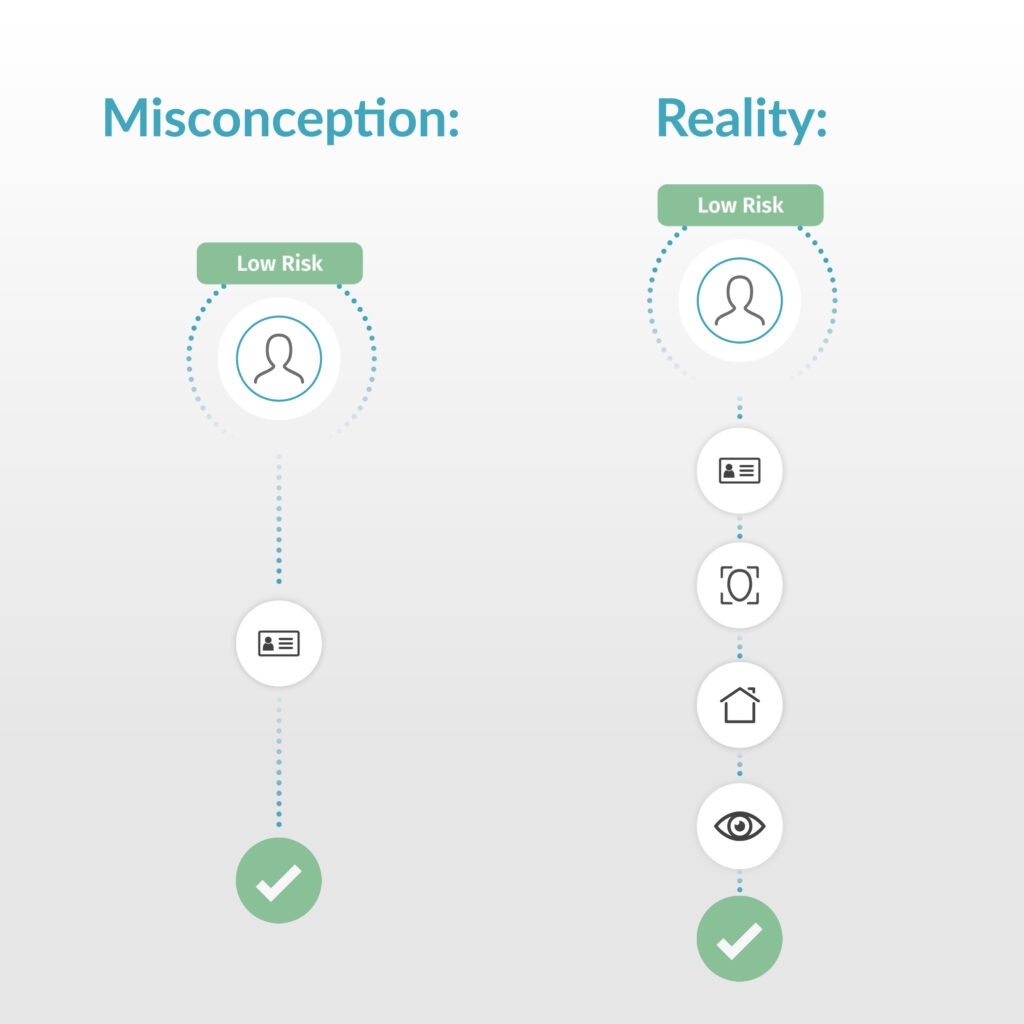

Misconception: Low-risk clients require minimal due diligence efforts.

Reality: Even for low-risk clients, some level of CDD is necessary. The extent may vary, but understanding their background remains important for risk management.

Handling high-risk clients shouldn’t necessarily lead to rejection; instead, it requires heightened diligence and ongoing reviews. Whilst technology plays a key role in enhancing efficiency, the importance of human judgment cannot be understated.

Customer Due Diligence (CDD) is a continuous process, not limited to just new clients, and encompasses a range of financial crimes, including those involving low-risk clients. Correcting these common misconceptions is essential for effective risk management and adherence to regulatory standards. Get started today for a free trial, and book a demo.