On Wednesday, 18th October 2023, the Solicitors Regulation Authority (SRA) hosted the annual Compliance Officers Conference at the ICC in Birmingham. The aim of the event? To bring together Compliance Officers for Legal Practice (COLPs) and Compliance Officers for Finance and Administration (COFAs) to understand the future of the regulatory landscape, with a focus on Anti-Money Laundering (AML) and Risk Management.

Established as an independent regulatory body, the SRA regulates law firms across England & Wales and plays a crucial role in upholding the standards and integrity of the legal profession. They regulate firms to ensure that their processes are compliant with the latest guidance. The key focus for the SRA is ensuring that firms understand the risks around money laundering and are doing all that they can to fight financial crime. This commitment is to maintain public trust and confidence in solicitors and the legal services that they provide through enforcing these regulations that solicitors must adhere to in their practice.

Anti-money laundering (AML) in law firms refers to a set of legal and regulatory measures designed to prevent and detect the illicit flow of money through legal services. It is an essential component of the broader global efforts to combat financial crime, such as money laundering and terrorist financing. Law firms are particularly vulnerable to these activities, given their role in transactions, trusts, and other legal arrangements that can be exploited for money laundering.

To address this, law firms are required to implement robust AML procedures, including customer due diligence, risk assessment, reporting suspicious activities, and internal controls. Together, these procedures aim to identify and mitigate the risk of lawyers inadvertently or knowingly participating in money laundering schemes, thereby upholding the legal profession's integrity and protecting financial systems from abuse. Compliance with AML regulations is not only a legal obligation but also a means of preserving the trust and reputation of law firms in the global financial ecosystem.

During the conference, the SRA presented the ‘good’ and the ‘poor’ processes that they have witnessed in the legal market around risk assessments and customer due diligence. Below is a breakdown of the processes identified in both areas

| The Good Practices | The Poor Practices |

| Speaking to all teams in the firm, not just compliance | Not having risk assessments or keeping them up to date |

| Tailored use of templates | Not considering all the firm’s services |

| Using data to understand risk | Not considering transaction risk |

| Regularly updating with changes of regulations and systems | Not reporting where enhanced due diligence is carried out |

| The Good Practices | The Poor Practices |

| Based on risk assessed on firm and matter level | Reliance on electronic due diligence without sense check |

| Documented and retained | Not applying enhanced due diligence when necessary |

| Picking up on SRA red flags | Source of funds checks missing |

| Utilising systems to assist | Failure to recognise work that brings the matter in scope of the regulations |

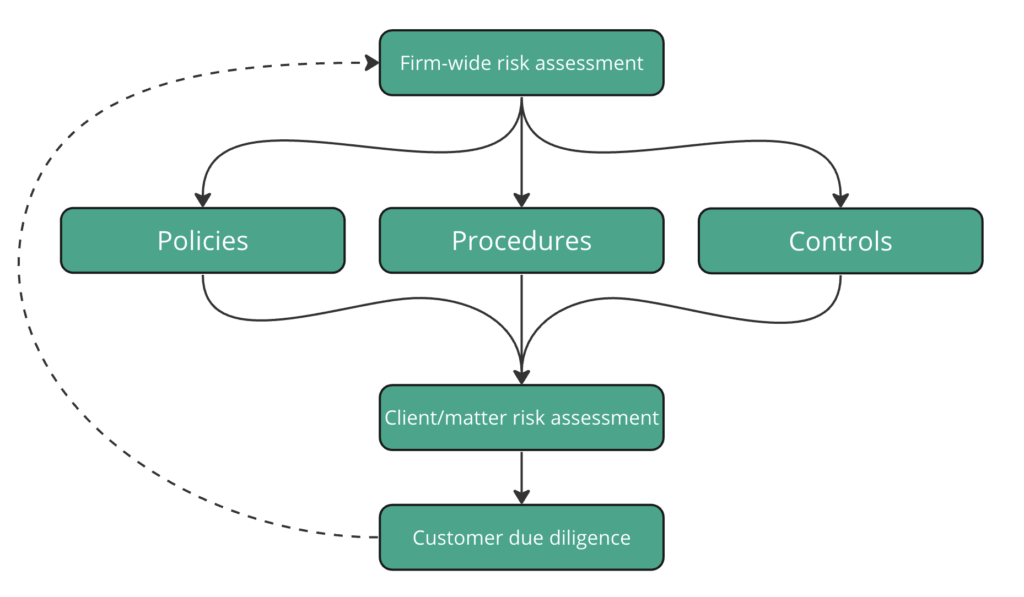

The opening presentation looked at what law firms need to know about AML. Colette Best (Director of AML at the SRA) explained the ideal risk flow that law firms should follow to ensure that their processes are concrete (as shown above).

Law firms should begin by creating or reviewing their firm-wide risk assessment to ensure that all areas of the firm are covered. The firm-wide risk assessment forms the foundation of the firm's policies, procedures, and controls which set the basis of the client/matter risk assessments. The client/matter risk assessment, where firms collect all relevant information on the client, whether an organisation or individual. The SRA has just published a client/matter risk assessment template that firms can use and adapt.

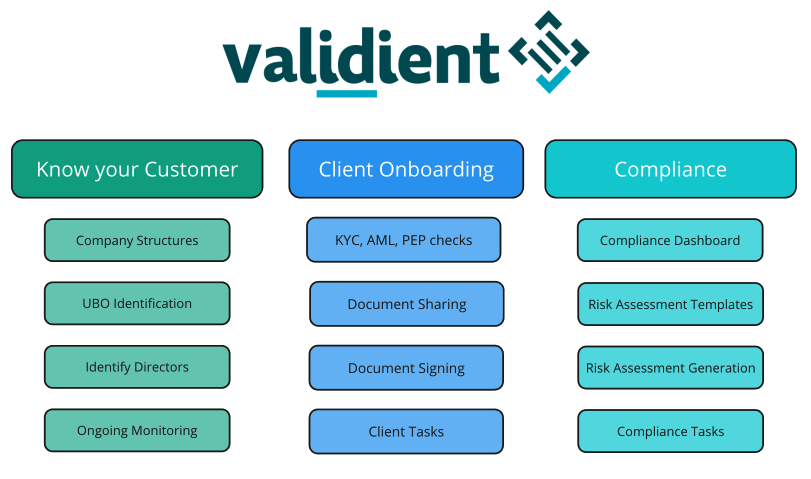

Validient is the leading platform on the market that incorporates the latest guidance set out by the SRA, to help law firms and regulated businesses remain compliant throughout the due diligence process. Below is a breakdown of what Validient can offer.

If you would like to learn more about how Validient is helping firms meet their AML and KYC-compliant requirements, whilst providing exceptional client-facing technology, book a demo with us today!