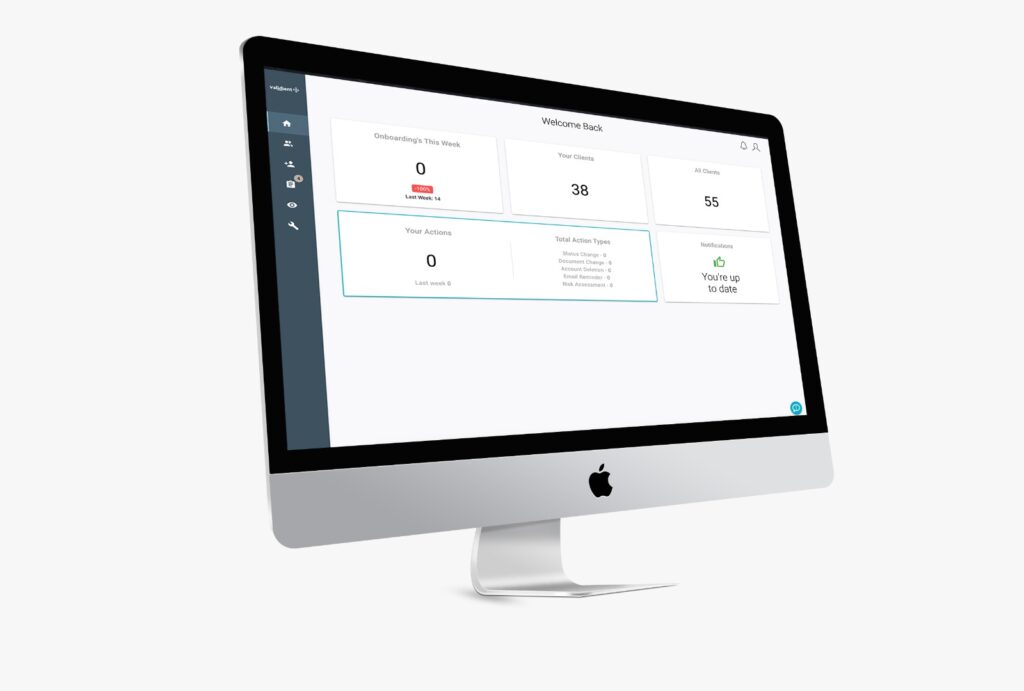

Here at Validient, we are always working hard to enhance current features and bring new features to our market. We do this to deliver the best digital client onboarding and risk monitoring solution possible for all regulated businesses and law firms.

How do we do this? We do this by listening to our customers, working with our advisors, and understanding the industry. This helps us know that the features we build will add genuine value to all firms, regardless of size.

The final quarter of 2022 saw the most significant update of new features to date, designed to deliver a complete digital client onboarding and ongoing risk monitoring solution. Tools designed to help law firms and regulated businesses operate with the highest level of due diligence, remain compliant, and reduce risk by knowing exactly who your clients are.

Let’s take a look at the key updates…

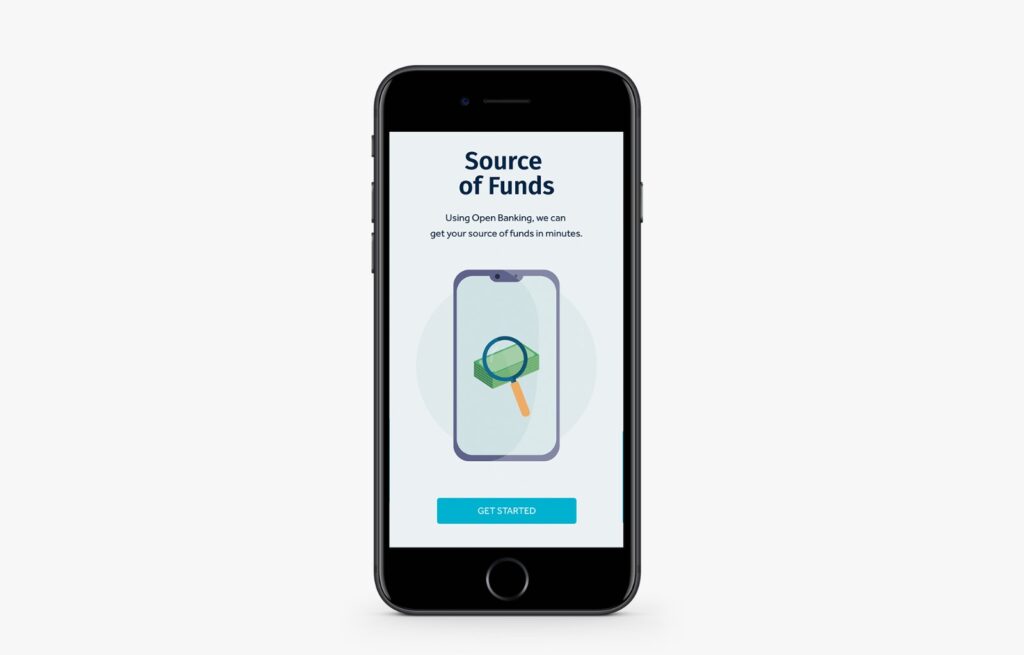

A proof of funds check is a type of bank check that verifies the holder has sufficient funds to cover a proposed transaction. This check is often used in real estate transactions, loan applications, and other financial transactions that require proof of financial stability. The check typically includes information about the account holder, account balance, date of issuance, and a breakdown of incoming and outgoing transactions. The proof of funds checks provides instant oversight that the funds are available for the intended transaction and help mitigate the risk of fraud and money laundering.

We have partnered with TrueLayer, a successful and well-established third party; clients then give permission for TrueLayer to access their bank through open banking technology. This allows a regulated business such as a law firm or real estate agent to identify any suspicious financial activity before conducting business, preventing risk.

Benefits to your firm:

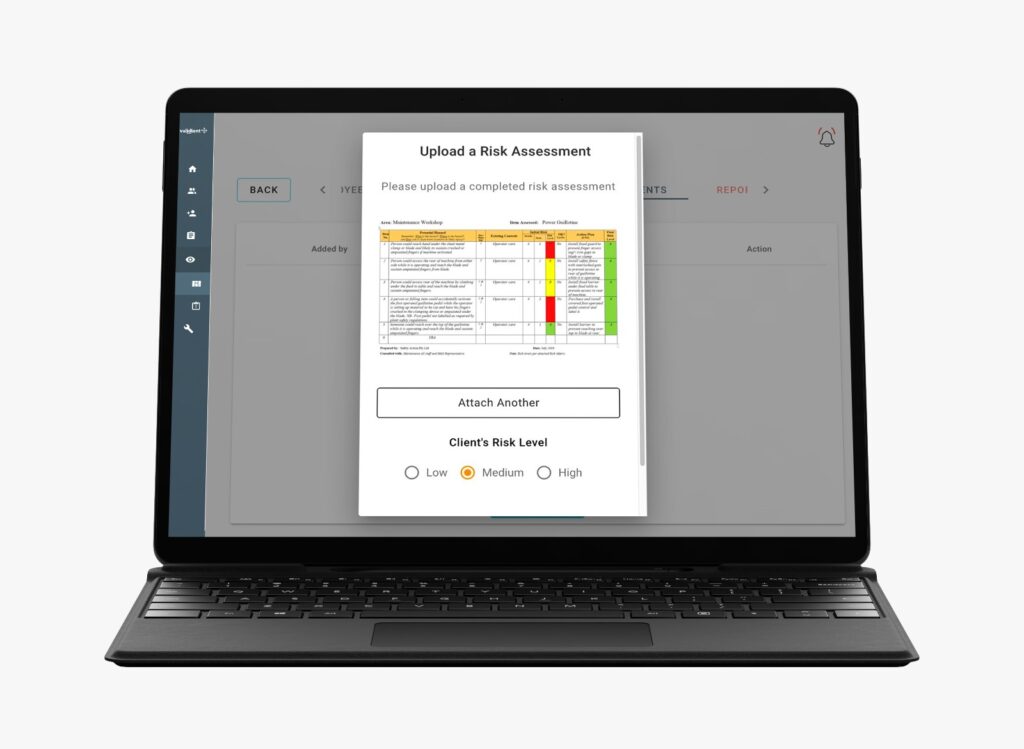

Understanding the potential risk of conducting business with a client can be make or break for a business. Our risk management solution allows you to manage how your firm stores and reports on clients' risk in a centralised location. By providing a centralised location to access, review and score clients, compliance teams full oversight of client risk profiles.

Client risk rating changed? Upload an updated risk assessment and the changes take effect company-wide and in real-time. If you feel that a client poses a further risk or is linked to money laundering or other financial crimes, report them discretely and securely within the Validient platform where your compliance officer and MLRO will be notified. You can then alert users if a Suspicious Activity Report has been filed against the client.

The risk management feature was designed to safeguard your business against potentially harmful clients. It allows you to identify and reduce risk, remain compliant and keep your business safe.

Benefits to your firm:

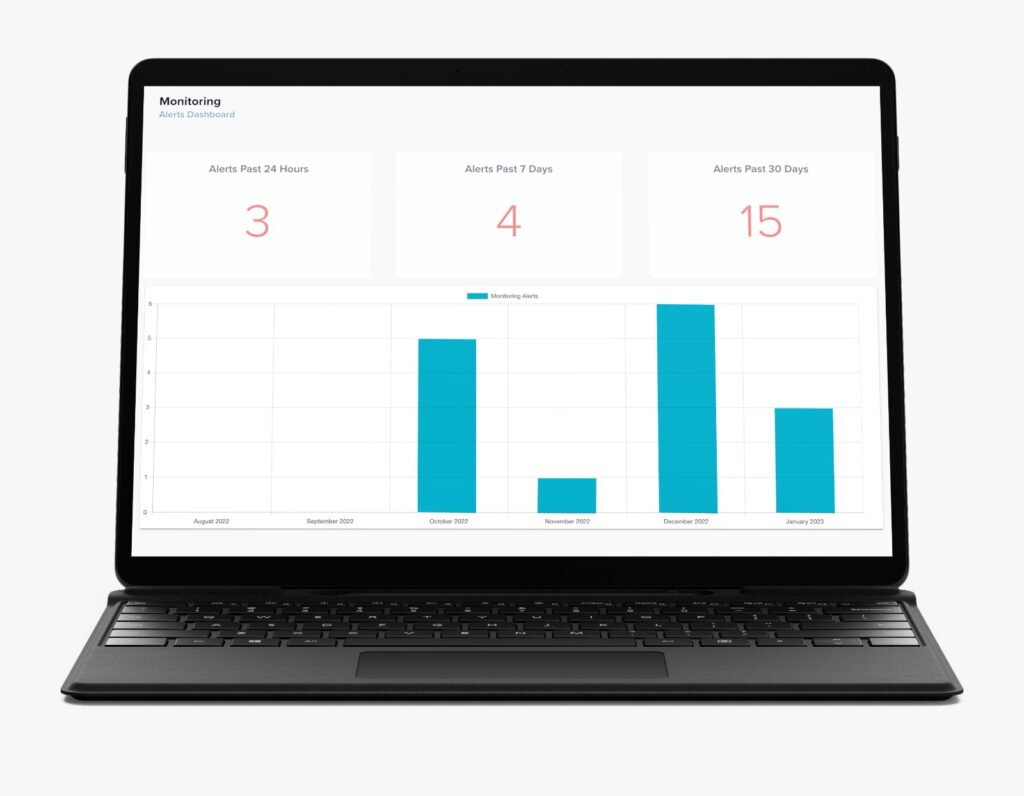

Ongoing monitoring refers to the systematic and continuous process of collecting, analysing, and reviewing information on your clients. It helps your law firm to identify and address problems in real time and make data informed decisions to reduce and prevent risk. Effective ongoing monitoring requires collaboration, clear communication, and the use of appropriate tools and technologies. When partnered with our Action Management feature, Validient’s solution offers business-wide protection by giving you the information you need to make better compliance decisions.

Onboarding clients is just the beginning; Validient's ongoing monitoring feature allows you to stay continuously updated on any changes in the status of your commercial clients. Dictate your own alert parameters and get notifications and alerts of insolvencies and bankruptcies. Fully understand your business relationship and all associated risk factors. A tool designed to become part of your compliance policy, always understand your clients and be alerted to changes that pose a risk to your business.

Benefits to your firm:

We aim to deliver nothing but benefits for your business by replacing current manual onboarding and monitoring processes with Validient's automated platform. Your business will see reductions in the cost of performing these checks and reductions in the time it takes clients to go from initial meeting to an onboarded client. Improve your clients experiences and increase customer retention.

We are so excited about these new features we have added. To our current customers - thank you for your feedback and willingness to assist in our future development. To new potential customers, we’d love to invite you to have your own bespoke product demo and 7-day trial.