Legal

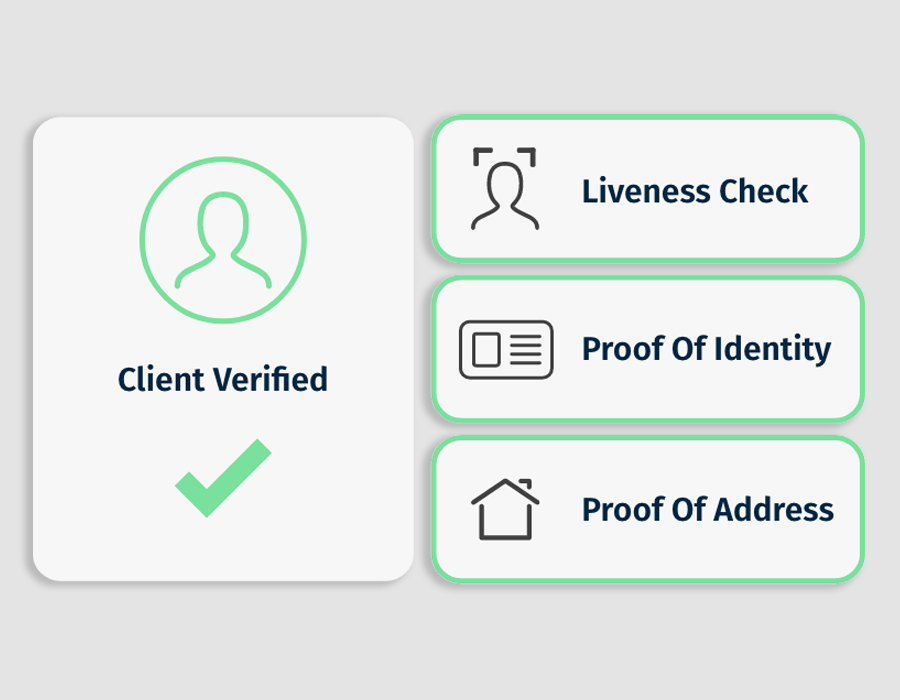

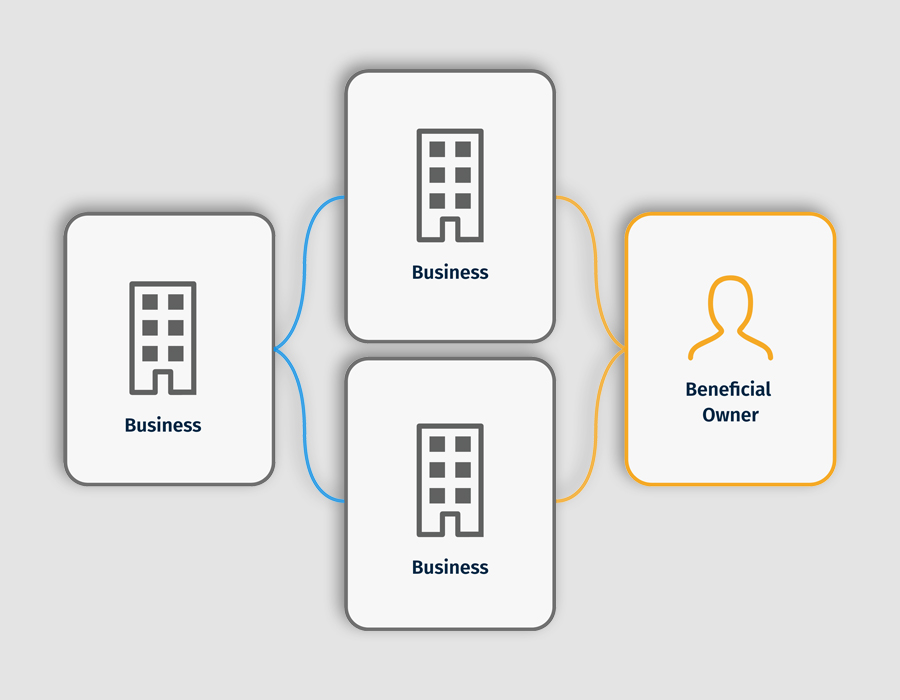

The handling of complex, high-value transactions and client accounts places the legal industry in a vulnerable position with respect to money laundering. For legal teams, client identity verification is a non-negotiable component of due diligence and risk management.

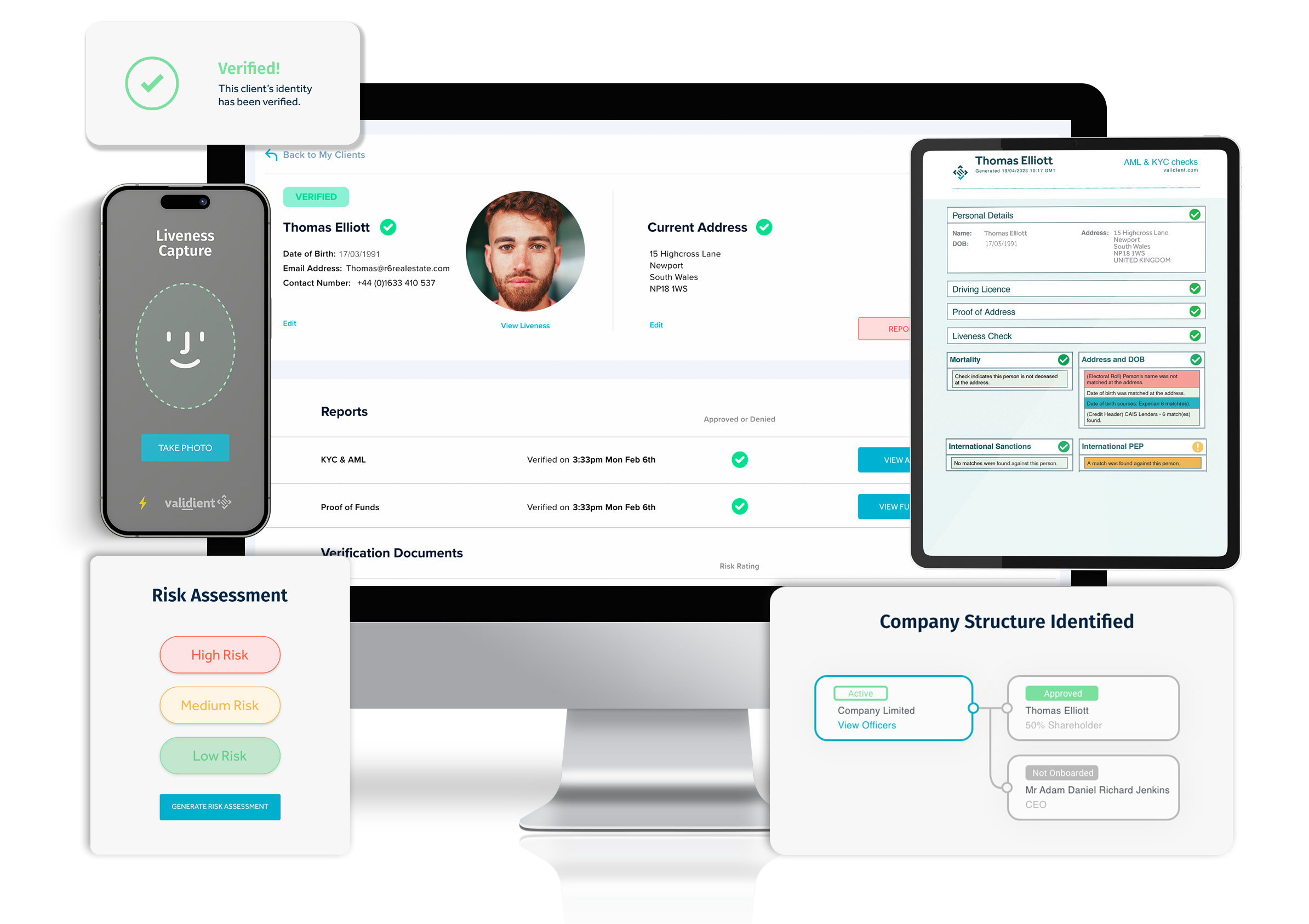

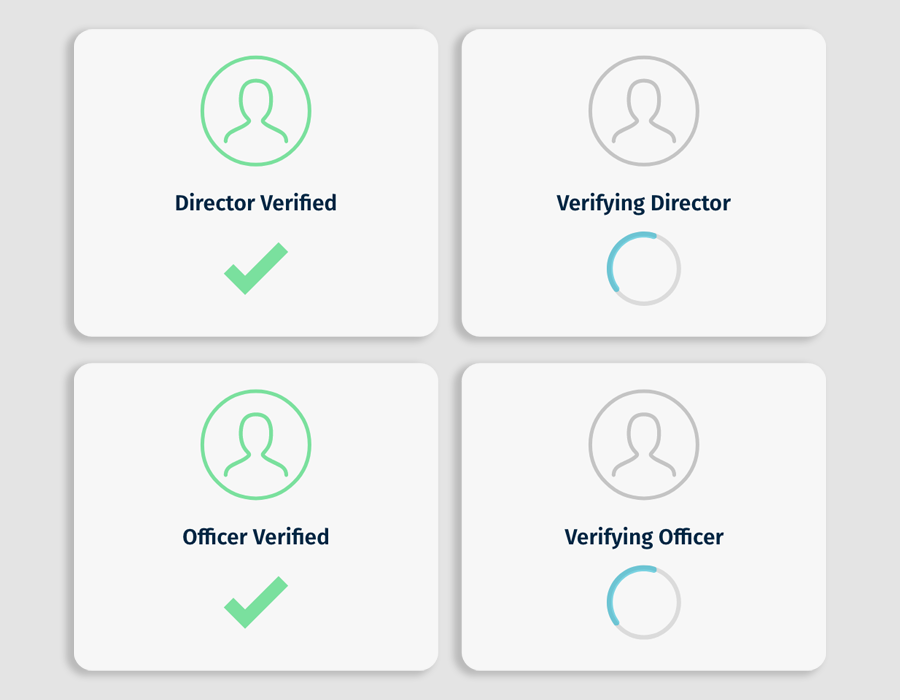

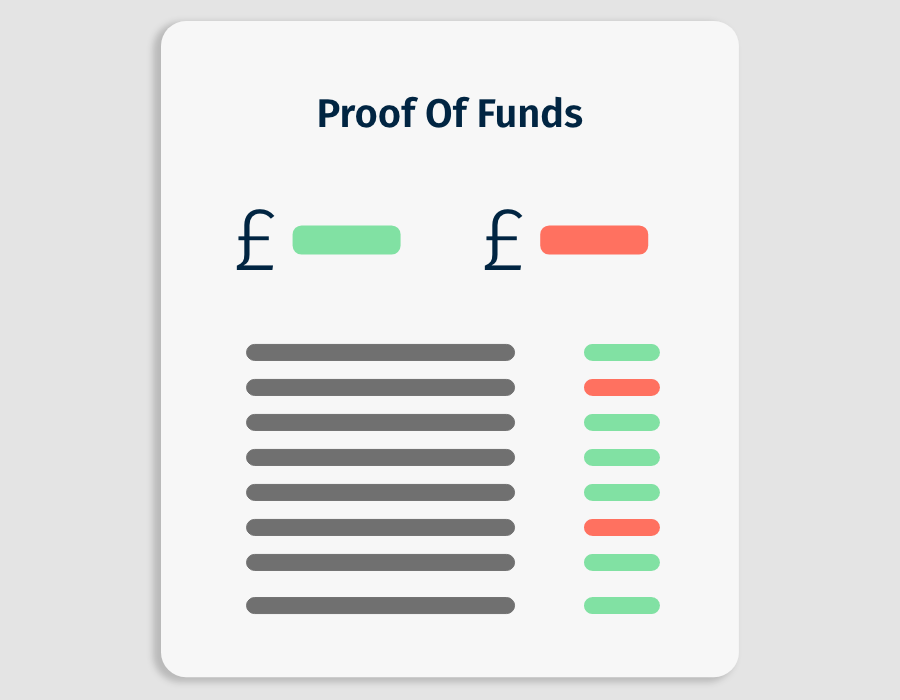

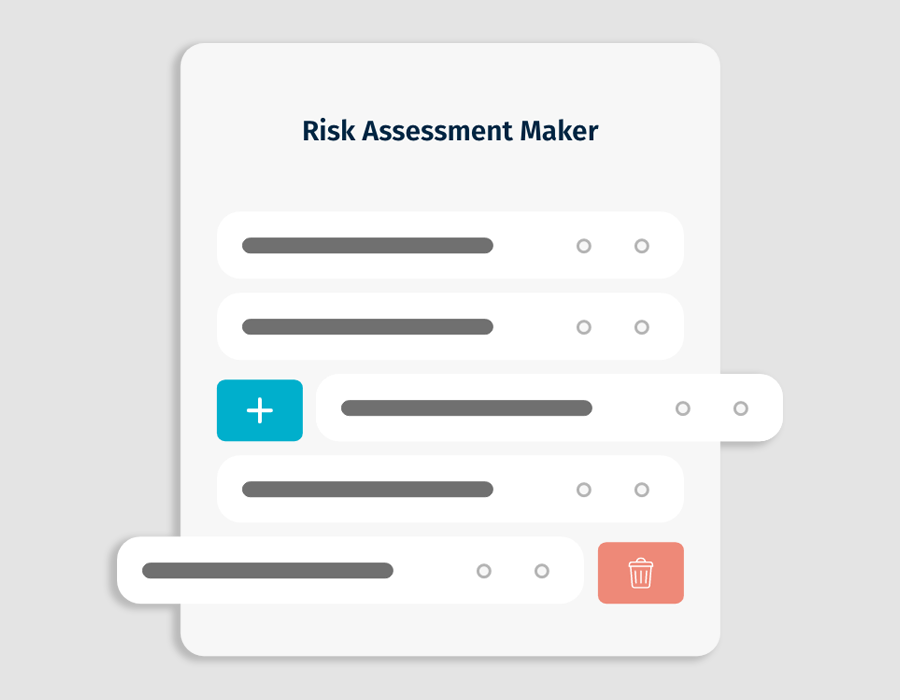

Validient specialises in the complete process of CDD, from the initial identification and verification, to the assessment of risk and ongoing monitoring on a client and matter basis, capturing the reasoning behind each decision.

Learn more